14. August 2023 | Structural Change and the Labour Market

The IAB-LinkedIn Reallocation Radar: “Great Resignation” is not a trend

Has the pandemic led to more and more employees being dissatisfied with their present job and quitting in resignation? The extent to which this phenomenon existed was initially discussed for the US, among others by Anthony Klotz, who coined the term “Great Resignation” in this context. There is no doubt that the prolonged coronavirus crisis has posed new kinds of challenges for many industries, has fundamentally changed previous work practices and has challenged established ways of proceeding. This may be associated with a major structural change.

However, it is by no means trivial to determine in how far this has recently led, or is still leading, to increased reallocations in the labour market. The reason for this is that detailed employment data is only available with a considerable delay. Not so with continually available online data. Thus, cross-industry transitions can be tracked almost in real time with data from the professional network LinkedIn. The respective job details in user profiles can serve as a basis – in anonymised form and aggregated to industries (see box “Data and Methods”).

The IAB-LinkedIn Reallocation Radar takes a new approach

In principle, such transitions could also be considered on the basis of forecasts of the employment level in various sectors. In a study published in 2020, José María Barrero and co-authors, for instance, draw on the expectations of firms about their employment development. However, these are obviously not only influenced by direct transitions between industries, but also by layoffs, retirements, new hires, recruitment of unemployed and other factors.

The approach taken with the IAB-LinkedIn Reallocation Radar is therefore rather different. In order to assess the dynamics of reallocation in the labour market, career transitions from other sectors are considered in relation to hires in the respective sector. The rate indicates what percentage of all hires are due to employees switching between the 20 standardised industries in LinkedIn’s industry taxonomy.

Only at the beginning of the COVID-19 pandemic did the number of employees switching industries rise briefly

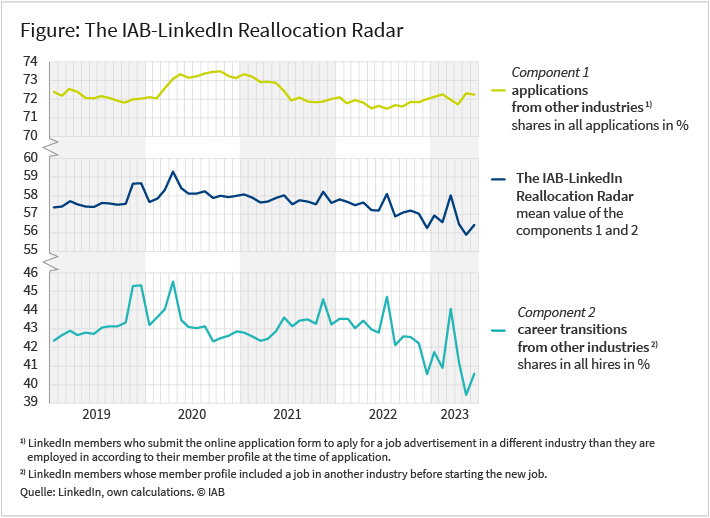

In the event of a “Great Resignation”, the rate would be expected to increase during the course of the coronavirus crisis, i.e. employees would change sectors more frequently. This was briefly the case at the beginning of the pandemic. Thereafter, however, the opposite was to be observed: The rate dropped significantly from spring 2020 onwards, contrary to the preceding positive trend. In 2021, the rate rose again, but not above the pre-crisis level. In 2022, with the energy crisis, it once again fell sharply. Apparently, vacancies were thus filled even less frequently overall via transfers from other industries than before the pandemic (see figure, lower line).

This is consistent with findings by Enzo Weber and Christof Röttger from 2021, who analysed data of the Federal Employment Agency. According to their research, the overall number of career transitions has decreased significantly during the Covid-19 pandemic. Only a few sub-sectors, such as food and beverage service activities, saw an intensified reallocation to other industries after unemployment.

In a follow-up publication from 2022, they moreover observed that such effects ceased to appear even in these sub-sectors after the peak of the crisis up to the second lockdown. Job quits then normalised towards pre-crisis levels in spring and summer 2021. Emanuel Bennewitz and others can also confirm a sharp drop in staff inflows and outflows during the pandemic and a partial compensation in 2021 with data from the IAB Establishment Panel. Luisa Braunschweig and others conclude in a recent IAB-Kurzbericht (IAB Brief Report 6/2023) that fewer of those employed in March changed jobs in 2020 than before the pandemic.

Using LinkedIn data to map current application behaviour

In addition, the LinkedIn data can be used to track how the number of applications has developed up to the recent past. While standard labour market statistics only provide information on completed processes, the current application behaviour may be observed here. Already in 2020, in a contribution to the IAB-Forum, IAB and LinkedIn have therefore analysed the search behaviour on the labour market in the first wave of the COVID-19 pandemic.

Since an application usually precedes a career transition, application data potentially provides a preview of future labour market events. In analogy to the reallocation rate, a sector-specific ratio of applications from other industries in relation to all applications in an industry can also be calculated here (see figure, upper line ). This rate rose considerably at the beginning of the pandemic. However, from mid-2021 onwards it fell even below the pre-crisis level. In 2023, there was a normalisation.

The application rate can serve as a leading indicator

In fact, it can be observed that after the upturn in the rate of applications from other industries, throughout 2021 the actual reallocations also increased. After the indicator of applications had fallen again, there followed after some delay a decline in the number of transitions. In the next months transitions might recover again, which would follow the upward trend in the application indicator from mid-2022 onwards.

The extent to which job applications provide information about the ensuing actual frequency of reallocations can be systematically estimated with the help of a so-called panel model (see box “Data and Methods”). This model shows for individual industries whether applications are systematically correlated with subsequent transitions.

There is indeed a highly significant statistical correlation between the event of an application and the reallocation in industries, which starts after eight months: When the application rate rises, the transition rate also rises with a time lag. The application rate is therefore a proven leading indicator for career transitions across sectors. The correlation is 46 per cent.

The LinkedIn data have the advantage that they are available on a monthly basis. In addition, the application behaviour monitored via LinkedIn provides a glimpse of future reallocation behaviour on the labour market. This information is also the basis for the new IAB-LinkedIn Reallocation Radar, which will be published biannually in the future in order to map current transition patterns in the labour market. This consists of two components:

- Transitions of today: The current ratio of career transitions from other industries and all hires

- Transitions of tomorrow: The current ratio of cross-industry applications and all applications

The IAB-LinkedIn Reallocation Radar represents the mean value of the two components (see figure, middle line). It can be seen that reallocations have been trending downwards since the end of the first lockdown. According to the application component (see figure, upper line), a Great Resignation is currently not to be expected in Germany after all. However, after the rather rigid crisis, transition dynamics might pick up again to a certain degree.

Conclusion

The IAB-LinkedIn Reallocation Radar is a tool to identify trends in sector switches at an early stage. The new indicator does not point to a Great Resignation in Germany. Future publications, which are planned on a biannual basis, will provide an insight into how the development will continue.

Note: Current data on the IAB-LinkedIn reallocation radar can be found on the IAB website.

Data and Methods

The data is provided in anonymised form and aggregated at industry level by LinkedIn’s Economic Graph team as part of a cooperation. New hires are defined as LinkedIn members who take up a job with a new employer and update their existing profile in the same month. Transitions are defined as those cases in which a job in another industry (with standardised industry specification) was entered in the profile while taking up the new job. Possible gaps are not necessarily recorded precisely as in administrative data.

All job applications (cross-industry applications, respectively) are defined as cases in which members submit the online application form in response to a job advertisement and indicate a job in the profile at that time (or a job outside the target industry). Transitions are therefore based on changes in profile – regardless of whether the recruitment resulted from using LinkedIn. Applications can only be gauged via the feature within LinkedIn.

However, by forming ratios, both can be represented as shares of the respective underlying total: the ratio of job transitions from other industries and total hires in the respective industry, as well as the ratio of applications from other industries and from all industries to the respective industry. By forming these ratios, effects that are only due to the growth of the LinkedIn platform are eliminated. The time series have been generated and seasonally adjusted at monthly frequency since the beginning of 2019.

The number of LinkedIn members in Germany, Austria and Switzerland exceeds 21 million at present. Compared to the overall workforce in Germany, manufacturing, self-employed, scientific and technical activities as well as information and communication are overrepresented on LinkedIn. The average individual on LinkedIn is well qualified and tends to work for large firms. Further information on the data structure can be taken from IAB Discussion Paper 33/2020.

The results can basically be confirmed with IAB social security data (SIAB). In this data, for instance, the average ratio of job transitions from other industries (WZ08, level 1) and total hires in the period from March to December 2020 is 1.6 per cent lower than in the same period of the previous year. In contrast, the trend in previous years was slightly increasing.

In order to study the leading characteristics of applications for actual transitions, a panel model is being estimated for the industries standardised in LinkedIn. The logarithmic rate of transitions to each industry serves as dependent variable. Industry-specific level effects are excluded by the use of differentials. A dynamic panel with a one-month lagged endogenous variable is estimated (by GMM). Four further lags are used as instruments. The application rate is used as an explanatory variable for each industry. Multiple lags are used here and the insignificant ones are discarded one by one.

The following industries are listed on LinkedIn:

- Accommodation Services

- Administrative and Support Services

- Construction

- Consumer Services

- Education

- Entertainment Providers

- Farming, Ranching, Forestry

- Financial Services

- Government Administration

- Holding Companies

- Hospitals and Health Care

- Manufacturing

- Oil, Gas, and Mining

- Professional Services

- Real Estate and Equipment Rental Services

- Retail

- Technology, Information and Media

- Transportation, Logistics, Supply Chain and Storage

- Utilities

- Wholesale

In Brief

- The Great Resignation debate in the US also drew attention to a possible reorientation of employees in Germany as a result of the COVID-19 pandemic.

- Data from the professional network LinkedIn is being used to analyse current industry transitions of employees as well as job applications. The latter serve as a leading indicator for upcoming transitions across different industries.

- Apart from a temporary rise at the beginning of the pandemic, it is evident that there was an overall decline in industry transitions during the pandemic. At present, cross-industry applications picked up to some extent, but it is not to be expected that a Great Resignation will yet occur in Germany.

- The IAB-LinkedIn Reallocation Radar is going to be published on a biannual basis in the future.

References

Barrero, José María; Bloom, Nicholas; Davis, Steven J. (2020): COVID-19 Is Also a Reallocation Shock. Brookings Papers on Economic Activity, Summer, p. 329-371.

Bauer, Anja; Keveloh, Kristin; Mamertino, Mariano; Weber, Enzo (2020): Wie die Corona-Krise die Suchprozesse am Arbeitsmarkt beeinflusst. IAB-Forum, 05.08.2020.

Bauer, Anja; Keveloh, Kristin; Mamertino, Mariano; Weber, Enzo (2020): Competing for jobs: How COVID-19 changes search behaviour in the labour market. IAB-Discussion Paper Nr. 33.

Bennewitz, Emanuel; Klinge, Silke; Leber, Ute; Schwengler, Barbara (2022): Zwei Jahre Corona-Pandemie: Die deutsche Wirtschaft zwischen Krisenstimmung und Erholung – Ein Vergleich der Jahre 2019 und 2021 – Ergebnisse des IAB-Betriebspanels. IAB-Forschungsbericht 20/2022.

Braunschweig, Luisa; Buch, Tanja; Buhmann, Mara; Kindt, Anna-Maria; Roth, Duncan; Seibert, Holger (2023): Berufswechsel zu Beginn der Covid-19-Pandemie: Nur geringe Auswirkungen auf Erwerbsverläufe. IAB Kurzbericht 6/2023.

Klotz, Anthony C. (2021): The Covid vaccine means a return to work. And a wave of resignations. NBC News THINK.

Röttger, Christof; Weber, Enzo (2022): Es gab keinen Big Quit in Deutschland. Ökonomenstimme, 23.06.2022.

Weber, Enzo; Röttger, Christof (2021): No BIG Quit in Germany. In: LSE COVID-19 blog, 24.11.2021.

DOI: 10.48720/IAB.FOO.20230814.02

Photo: Andrii Yalanskyi/stock.adobe.com;

Weber, Enzo; Erer, Murat (2023): The IAB-LinkedIn Reallocation Radar: “Great Resignation” is not a trend, In: IAB-Forum 14th of August 2023, https://www.iab-forum.de/en/the-iab-linkedin-reallocation-radar-great-resignation-is-not-a-trend/, Retrieved: 27th of April 2024

Authors:

- Enzo Weber

- Murat Erer

Professor Enzo Weber is Head of the Research Department "Forecasts and Structural Analyses" at the IAB. He develops current policy proposals for labour market and economic challenges and advises national and international governments.

Professor Enzo Weber is Head of the Research Department "Forecasts and Structural Analyses" at the IAB. He develops current policy proposals for labour market and economic challenges and advises national and international governments. Murat Erer is a Data Scientist at the professional network LinkedIn.

Murat Erer is a Data Scientist at the professional network LinkedIn.